Integrating climate finance into India's economic blueprint

Pradeep S. Mehta, Secretary-General of CUTS International, suggested that India's 2024-25 Budget should include dedicated climate finance institutions through public-private partnerships during a webinar on accelerating private investment in climate finance. Mehta stressed the importance of private sector involvement for a sustainable and resilient future, highlighting the need for collaboration, innovation, and commitment.

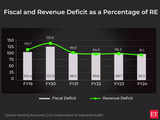

Will Sitharaman stick to fiscal prudence this time around?

Fiscal Deficit of India 2023-24 | Finance Minister Nirmala Sitharaman's 2024 Budget, scheduled for July, aims to navigate India's fiscal deficit amidst varied economic priorities and coalition dynamics. With fiscal discipline crucial, the Modi 3.0 government seeks to balance capital expenditure initiatives with rural, healthcare, and educational needs while aiming to achieve a fiscal deficit target of 5.2% and eventually 4.5% by 2025-26 | Union Budget 2024

MSME ministry seeks additional ₹5,000 crore for job generation scheme

The ministry of micro, small and medium enterprises is seeking an additional ₹5,000 crore for the Prime Minister's Employment Generation Programme due to a surge in subsidy claim applications. Budget constraints and an overwhelming number of applications have led to delays in subsidy disbursement. In FY24, Union Bank of India had the highest subsidy claim and release under the scheme. The government subsidizes a percentage of the loan amount for self-employment ventures, with applicants required to contribute towards the project cost. Despite the high demand, the budget allocation for PMEGP in the current year is lower than the revised estimates for the previous year.

Ahead of Sitharaman’s big announcement, a look at govt’s forex war chest to deal with external shocks

India Forex Reserve FY 2023-24 | Finance Minister Nirmala Sitharaman is set to present her seventh Budget in July 2024 amid robust economic indicators, including India's substantial foreign exchange reserves of nearly $654 billion. The Modi 3.0 government's first full budget comes amidst high capital inflows and resilient forex management, underscoring economic resilience and strategic fiscal planning

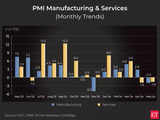

Will India’s robust manufacturing segment sway Sitharaman’s decisions? A look at PMI numbers

India manufacturing PMI Budget 2024 | Finance Minister Nirmala Sitharaman's upcoming Budget for 2024 is set against the backdrop of robust manufacturing PMI readings, signaling strong economic growth. The latest GDP figures for Q4 and FY24 underscore this momentum, driven by resilient manufacturing and services sectors. Amid global uncertainties, the budget aims for continuity, balancing growth and coalition priorities.

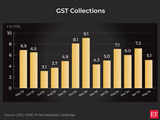

India’s GST kitty remains central focus; a look at overall collection

India GST Collection Budget 2024 | Finance Minister Nirmala Sitharaman is set to incorporate robust Goods and Services Tax (GST) collections, hitting Rs 2.1 lakh crore in April 2024, into Union Budget 2024. With May's collections at Rs 1.73 lakh crore, GST continues to streamline, aiding government fiscal strategies amidst economic growth and coalition governance challenges.

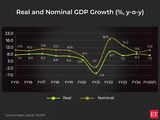

A look at India’s GDP growth rate before Sitharaman sets the ball rolling in Lok Sabha

Budget 2024 GDP | Finance Minister Nirmala Sitharaman is preparing to unveil Union Budget 2024 in July, underlining India's robust GDP growth. With GDP climbing to 7.8% in Q4 FY24 and an estimated 8.2% for FY24, policies will focus on sustaining growth momentum. The budget aims to align economic strategies with evolving demands amidst global uncertainties.

A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

India's economy: A-Z all you need to know before announcement of Union Budget

Union Budget will be announced by Finance Minister Nirmala Sitharaman in late July. The report covers key economic indicators, including India's GDP growth at 7.8% in Q4FY24, concerns over consumption expenditure, stable retail inflation at 4.7%, fiscal deficit reduction to 5.6% in FY24, and a narrowing trade deficit | Budget 2024

CM Naidu to raise budget-specific demands in meeting with PM, FM

During the budget discussions, I will address various development needs in Andhra Pradesh and seek support from BJP, highlighting the state's requirements in the Union Council of Ministers.

First Budget of Modi 3.0: 8 stocks which may come into limelight during the Budget speech

Till the budget comes, many would have field day, right from opinion, desire, assessment all being packed as inside news. So, at the outset, we must clarify that this is our assessment based on an assumption that there are certain sectors which will be getting more attention in the first budget of Modi 3.0. The assumption is based on two reasons. First, the government has been focussing on these sectors for some time now and will give it further push so that end results start to get reflected on ground. Second, given the fact that it makes sense to do politically correct things when the whole world is looking at you. Why not make those announcements in the budget itself, because if not in budget these would have come in any case over the next few months. These are mid and small caps stocks which are related to the rural economy which is likely to be in focus for next couple of years as policy makers once again get ready for rural push.

10 ways the finance minister can ease income tax and financial burden of senior citizens

Income tax Budget 2024 expectations: A notable percentage of taxpayers in India are senior citizens since they receive income, frequently through passive means. ET Wealth Online interviewed three specialists to discuss senior citizens' expectations for the forthcoming Union Budget 2024.

Outlay for export tax remission plans unlikely to change

The government is unlikely to increase the allocation for key tax remission schemes for exporters in the 2024-25 budget, despite demands for more support. In the interim budget, ₹16,575 crore was earmarked for the RoDTEP scheme and ₹9,246 crore for the RoSCTL scheme. Exporters argue for adequate allocation to maintain zero-rated exports, a government policy, as merchandise exports rose 5.1% year-on-year in the first two months of this fiscal.

Karnataka seeks Gujarat’s GIFT city-like facility for state from Centre ahead of Union Budget

Pushing for a Central Business District akin to GIFT City, Karnataka seeks rapid project approvals and funding for infrastructure, emphasizing economic growth, job creation, talent development, and research initiatives.

Import duty cut on the cards? India gold buyers postpone their purchasing plans

BUDGET NEWS: Indian gold demand remains subdued due to high prices, with expectations of an import duty cut in the upcoming budget. Meanwhile, Chinese demand also declined. Domestic gold prices hovered near Rs 71,600 per 10 grams, down from a peak of Rs 74,442 last month. Dealers offered discounts up to $9 per ounce on official prices, including taxes. The market anticipates increased activity closer to the festival season in Q3

Why govt should hike 80D limit under old tax regime

Budget 2024 Section 80D Exemption: Taxpayers who have opted for the old tax regime are hoping for an increase in the limit under section 80D in the upcoming July 2024 budget, considering the significant rise in healthcare costs.

Sharpen focus on education and health this Budget, experts urge FM

Although the pandemic is behind us, the focus on the health sector shouldn't be diluted, he added. There were also suggestions to tightly monitor the implementation of all such social sector schemes, he added. Facilities at schools and hospitals need to be further improved and vacancies filled up on time, some of them said in the meeting. In the interim Budget for FY25 in February, the government had pegged the outlay for the Ministry of Health and Family Welfare at ₹90,659 crore, up marginally from the FY24 budget estimate of ₹89,155 crore. This outlay also includes spending on health research.

Will Budget 2024 end 'pardesi' treatment of NRIs?

Under Indian tax laws, NRIs are taxable on their Indian-sourced income, such as capital gains, dividends, and interest. They are generally taxed similarly to residents but may face less beneficial rules in specific scenarios. The upcoming Budget 2024 may offer relief to NRIs in these areas.

Budget 2024 will see many historic economic policies, will be a futuristic one: President Murmu at Parliament

In her address to Parliament, President Droupadi Murmu announced that the upcoming Union Budget will introduce historic economic policies and reforms at an accelerated pace. Highlighting India's contribution of 15% to the global economy, she emphasized that this budget will reflect the government's long-term policies and futuristic vision. Finance Minister Nirmala Sitharaman is set to present this Union Budget in July 2024.

Make in India, the next season: India planning big B-Day release for several new measures

India has launched several initiatives to attract investments to the country, presenting itself as an alternative manufacturing destination to companies seeking a China+1 supply chain shift. The IT hardware and mobile phone programmes have seen success. The Centre is hopeful of a similar shift in other sectors as well and there is a view that PLI plus a lower corporate tax rate will offer investors a competitive return on investment.

Budget 2024: Hi-tech thermal plants may get Rs 6,000 cr viability support

Budget 2024: The Union budget for 2024-25 is expected to include a support scheme for setting up 800 MW coal-based power plants using Advanced Ultra Supercritical (AUSC) technology. The finance ministry is evaluating a proposal for ₹6,000 crore viability gap funding (VGF) and a ₹3,500 crore payment security mechanism for electric buses. The project, based on indigenous technology developed by a consortium of Bharat Heavy Electricals Limited, Indira Gandhi Centre for Atomic Research, and NTPC, is expected to cost upwards of ₹15,000 crore at completion.

These cities should be included in 50% HRA exemption list

Budget 2024 HRA Exemption: Many employers offer an HRA as part of their employees' compensation. If an employee receiving HRA is paying rent for their accommodation, they can claim a tax exemption on the HRA. Currently, a rented house in Delhi, Mumbai, Kolkata, and Chennai qualifies for a 50% exemption from HRA, while those located in other places come under the 40% bracket.

Why FM should increase the 80C limit in Budget 2024

Section 80C deduction in Budget 2024: The 80C limit has not increased in line with many people's income and costs. Because of this gap, many taxpayers use the entire 80C limit. This is why many want this limit to be increased.

Budget should double std deduction, raise basic exemption to Rs 3.5 lakh under new tax regime: EY

EY recommends significant tax reforms in the upcoming Budget, urging the government to double the standard deduction under the new concessional tax regime to Rs 1 lakh or increase the basic exemption limit to Rs 3.5 lakh. Key suggestions include maintaining corporate tax stability, rationalizing TDS provisions, and improving dispute resolution mechanisms.

FHRAI seeks infra status for hotels, convention centres in pre-Budget meet

The Federation of Hotel and Restaurant Associations of India (FHRAI) has urged the government to grant infrastructure status to all hotels and convention centers costing Rs 10 crore or more. This request, part of their pre-budget recommendations, aims to boost investment in budget hotels. FHRAI also proposed a uniform 12% GST rate for all hotels and advocated for separating restaurant tariffs from room tariffs to reduce compliance issues

What Indian industry wants from Modi's budget after poll setback

The upcoming budget aims to boost consumption, support farmers, create jobs, and reform tax systems. It focuses on tax cuts, lifting export restrictions, job creation incentives, and simplifying tax regimes like capital gains and GST for a stronger economic outlook.

Faceless I-T assessment likely to turn friendlier soon

"It is being reviewed to assess effectiveness," said an official, adding that there is a line of thinking that it should be made optional for taxpayers. Another official said the idea is to address challenges in its implementation to ease compliance further for taxpayers. A final call will be taken shortly, the official said. The scheme was introduced on April 1, 2021, to reduce the human interface in tax disputes and assessments.

Budget 2024: Govt may adjust income criteria for housing aid in urban areas

The government is preparing to revise the income criteria for middle-income groups (MIGs) to qualify for assistance under the Pradhan Mantri Awas Yojana (Urban) [PMAY(U)]. This change, expected to be included in the 2024-25 budget, aims to better target the housing scheme in urban areas.

Skilling industry demands incentives, tax rebates and labour codes in meeting with FM Sitharaman

Ahead of the Union Budget for 2024-25, the Union Minister of Finance and Corporate Affairs held the eighth Pre-Budget Consultation in New Delhi, focusing on employment and skill development. Key figures like Anshuman Magazine and Suchita Dutta emphasized the need for skilled workers and job readiness among graduates. Discussions also highlighted incentives for skill improvement and formal employment practices, including lowering GST rates for employment services. There were calls for greater inclusion of women in the workforce and the expansion of social security measures. Startups advocated for foreign language education to tap into global job markets.

Budget 2024: 25% share by Indian liners could save $50 billion annually, says FIEO

Key export-related demands included creating an Indian shipping line, duty cuts, and extending credit schemes. Nasscom pushed for favorable policies like transfer pricing rules and deep tech clarity, with officials present to address concerns.

Leather, footwear exporters seek PLI scheme in Budget to boost jobs, manufacturing, shipments

The Council for Leather Exports (CLE) urged the government to extend the Production-linked Incentive (PLI) scheme for the leather and footwear sector to boost job creation and manufacturing. At a pre-budget meeting, CLE Chairman Rajendra Kumar Jalan also requested import duty exemptions on wet blue, crust, and finished leather to enhance competitiveness.

Industry pitches for tax reduction, rationalisation of duty structure in Budget

During a pre-budget meeting with Finance Minister Nirmala Sitharaman, industry representatives urged for reduced indirect taxes and rationalized duty structures. FIEO's Ashwani Kumar requested extending the Interest Equalisation Scheme for five years. Reliance Industries sought a review of tariffs on Chinese imports, and Nasscom pushed for easing transfer pricing rules.

RSS-affiliate union seeks extension of mandatory work under MGNREGA to 200 days in pre-Budget meet

BUDGET EXPECTATION: In its pre-budget meeting with the finance minister Nirmala Sitharaman on Monday, BMS general secretary Ravindra Himte demanded increasing the minimum pension under the Employees’ Pension Scheme (EPS), 1995 from Rs 1,000 to Rs 5,000 while enhancing of honorarium of scheme workers, especially for Asha, Aanganwadi, Mid-day Meal and National Health Mission workers, the central trade union said in a statement issued on Tuesday.

Budget wish list: Realtors want government to rationalise taxes, allot more for SWAMIH

Real estate developers are seeking measures in the upcoming Union Budget, including SWAMIH fund allocation, GST input tax credit, and rental housing incentives to support growth and demand creation.

Finance Ministry calls meeting with PSBs to review financial inclusion schemes ahead of budget

Finance ministry has scheduled a meeting on Tuesday with heads of state-owned banks and financial institutions. The purpose of the meeting is to review the progress of the government's key financial inclusion schemes, including the Jan Dhan Yojana, Jan Suraksha Yojana, and Mudra Yojana, ahead of the budget.

Pre-Budget meet: Exporters to seek support measures to boost exports

Exporters are set to discuss fiscal support measures with Finance Minister Nirmala Sitharaman on Tuesday aiming to boost India's exports to USD 2 trillion by 2030. This goal encompasses both goods and services, reflecting a marked increase from the current USD 778 billion in 2023-24.

Budget 2024 may increase standard deduction under new income tax regime

Will Budget 2024 increase standard deduction: The Finance Minister in the 2023 Budget included a standard deduction of Rs 50,000 for salaried taxpayers and individuals getting pensions in the new tax regime. This standard deduction was made the automatic choice, unless taxpayers chose not to take it.

Trade unions seek restoration of OPS, increase in tax rebate for salaried class

In their pre-budget meeting with finance minister Nirmala Sitharaman on Monday, the joint platform of 10 central trade unions, barring the Bhartiya Mazdoor Sangh, suggested government to enhance resource mobilization through enhanced corporate tax and wealth tax, raise the ceiling limit for the income tax rebate for the salaried class, set up the social security fund and fill up all the existing vacancies in the central government departments and public sector undertakings with regular employment while doing away with contract jobs.

Central govt employees seek rationalised income tax slabs and old pension scheme from Budget

Central government employees are advocating for key reforms in the Union Budget 2024-25. Their demands include rationalization of income tax slabs, the restoration of the old pension scheme, the establishment of the eighth central pay commission, improved home loan recovery terms, enhanced medical facilities, and income tax exemptions for pensioners.

Focus on upcoming Budget: Policy in the works on finance, health support for elders

India is considering policy measures for senior care, including expanding healthcare access through Ayushman Bharat, revising pension under the Indira Gandhi scheme, and providing healthcare under NPHCE.

States seek infra, rural push in pre-budget meet with FM Sitharaman

States presented demands for higher special assistance, increased allocations for rural schemes, and support for housing programmes to Finance Minister Nirmala Sitharaman in the pre-budget meeting. Sitharaman highlighted the Centre's aid to states through timely tax devolution and release of GST compensation arrears. Andhra Pradesh requested central funds for various projects and initiatives, including the development of Amaravati as its capital.

India mulls income tax cuts in Budget as part of $6 billion consumer boost

India Budget Tax Expectations: India's government under Prime Minister Narendra Modi is considering measures worth over 500 billion rupees to boost consumption in the upcoming budget. This includes tax cuts for lower income individuals for the first time in seven years. The plan aims to target consumers with high propensity to spend amidst economic challenges.

FM underlines Centre's support to states via timely tax devolution, GST compensation arrears

Union Budget: Finance Minister Nirmala Sitharaman emphasised the Centre's commitment to supporting states through timely tax devolution and GST compensation arrears to boost economic growth during a pre-budget meeting with state finance ministers. She encouraged states to utilize the 50-year interest-free loan scheme for reforms. States appreciated the assistance and provided suggestions for the upcoming Union Budget, with specific requests for projects and allocations.

Tax sops, higher capex, stable tax regime top industry wishlist

Budget expectations: Indian industry and financial institutions had their customary pre-budget consultations with Finance minister Nirmala Sitharaman on Thursday. The suggestions from India Inc included tax sops, capex boost as well as tax stability.

Modi 3.0 may have to redo the Budget math to provide more money to Naidu & Nitish-ruled states

Union Budget: Following recent Indian election results, Prime Minister Narendra Modi reasserts control over the federal government. Despite depending on various allies for support, none have significant ministerial roles. The focus shifts to relations between New Delhi and influential state governments, with demands for increased federal funds. The upcoming budget will reveal potential shifts in India's policy landscape.

Budget wishlist from agriculture & MSMEs stakeholders: Sops, infra push, easy loans and PLI schemes

Stakeholders from the agricultural sector and MSMEs provided key suggestions to Finance Minister Nirmala Sitharaman during pre-budget consultations. Suggestions included rationalizing fertilizer subsidies, boosting agricultural infrastructure investment, and implementing employee-centric production-linked incentive schemes.

Finance Minister Nirmala Sitharaman chairs fifth pre-budget consultation with MSME representatives

Union Minister Nirmala Sitharaman chaired the fifth Pre-Budget Consultation in New Delhi, focusing on inputs from the MSME sector for the forthcoming General Budget 2024-25.

Budget 2024: India looks for infra push; may tap funds from UK, Saudi & Japan

In the upcoming Budget, Finance Minister Nirmala Sitharaman is set to prioritise infrastructure investment to boost demand for steel, cement, and create jobs. The Indian government eyes funding from the UK, Saudi Arabia, and Japan for specific projects like roads and highways. Investor concerns, equity offerings, and environmental considerations are key factors in attracting investments.

RAI's Budget wishlist: Lower taxes for individuals, benefits on land rates, electricity

BUDGET EXPECTATIONS: The Retailers Association of India (RAI) has urged the Union Budget FY25 to focus on lowering individual taxes to boost demand and consumption. RAI's pre-Budget recommendations include low-cost financing, subsidies on land and electricity, and the adoption of supportive policies to strengthen the retail sector, which contributes 10% to India's GDP

By eliminating exemptions in direct taxes, complexities and litigation costs can be removed

The article delves into the historical quirks of taxation, from ancient Egypt to medieval England, highlighting the unique taxes imposed by various rulers. It discusses the current scenario of tax reform anticipation with the upcoming Union budget, resonating with the historical dread of tax season.